Shop with confidence! Safe, Reliable and Discreet Worldwide Shipping - Except (US)

If you’re searching for a place to buy Cannabis online with stealth shipping, look no further.

“We believe access to cannabis should be fast, safe and easy process”. But we advise you to get acquainted with your country drug laws, we take no responsibility and assume no liability.

DrWeed.Shop is an online Weed and Hash dispensary that ships directly to you, no matter where you are in the World. - Except United States (US) due to the new domestic legislation (STOP Act) that makes it impossible for us to send the Orders.

Bitcoin, Ethereum, Dogecoin accepted here

Free Shipping

Free Shipping all orders!

Safety and Security

Odor and X-ray Proof Bags

Fast and Efficient

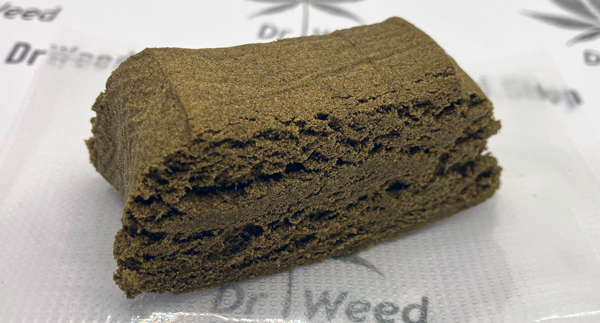

Quality Products Delivered